When it comes to cybersecurity in financial services, most security concerns center around familiar threats such as ransomware, phishing, credential theft, and cloud misconfigurations. But while institutions layer up defenses above the operating system (OS), one of the most foundational components of the IT stack often remains unmonitored and unprotected: BIOS firmware.

It’s a quiet, persistent risk. And one that’s becoming increasingly difficult to ignore.

The Blind Spot Beneath the OS

BIOS is the firmware responsible for booting a system and initializing hardware before the OS even starts. It’s the first link in the chain of trust and effectively sets the rules for everything that follows. If compromised, it allows attackers to operate below the radar of traditional security controls, persisting undetected across reboots, reimaging, and even hard drive replacements.

Despite this, most security teams at financial institutions lack visibility into BIOS integrity. While endpoint protection, SIEMs, and vulnerability scanners keep watch above the OS, firmware sits in a blind spot – quietly assumed (or rather hoped) to be secure but rarely verified.

That assumption is risky.

Why Attackers Are Eyeing BIOS Firmware

BIOS firmware attacks aren’t theoretical. We’ve already seen real-world examples—LoJax, the first UEFI rootkit used in the wild; TrickBoot, an evolution of TrickBot that probes firmware-level vulnerabilities; and more recently, BlackLotus, a stealthy UEFI malware which operates at computer startup, compromising systems and disabling OS security mechanisms. These types of threats are particularly attractive to both nation-state actors and financially motivated adversaries looking for persistence, stealth, and control.

For attackers, BIOS-level compromise is like gaining a skeleton key to a system. They can disable security tools, subvert boot processes, and maintain control even after the OS is wiped and/or reinstalled. And because most detection tools aren’t looking at firmware, these compromises can remain in place for months. Or even years.

The financial sector, with its high-value data, complex infrastructures, and regulatory scrutiny, presents a prime target. Trading systems, authentication gateways, and compliance platforms all rely on hardware integrity – yet the firmware that boots them is often left unchecked.

Compliance Isn't Keeping Up

NIST 800-53 explicitly addresses firmware in several key control families, including System and Communications Protection (SC), System Integrity (SI), and Configuration Management (CM). Controls like SI-7 (Software, Firmware, and Information Integrity), CM-6 (Configuration Settings), and SC-28 (Protection of Information at Rest) outline the need for monitoring, protecting, and validating firmware as part of a broader system integrity strategy.

Yet in practice, BIOS firmware often remains outside the scope of routine audits and security controls.

Organizations may assume compliance by securing applications and operating systems. But without actively managing BIOS-level integrity through attestation, version control, and secure update mechanisms they’re falling short of fully satisfying 800-53’s intent.

This oversight creates real compliance risk. As NIST continues to evolve and enforcement becomes more stringent, institutions that ignore the firmware layer could face increased scrutiny, audit findings, and operational consequences. That’s because a BIOS-level compromise isn’t just a technical issue. It’s a failure to implement fundamental safeguards required by a framework most institutions already claim to follow.

The Business Risk Is Bigger Than IT

When firmware is compromised, the impact isn’t just technical. It’s operational and strategic.

Imagine this: A trading system is taken offline due to a BIOS-level implant. Because the malware is persistent, even reinstalling the OS doesn’t remove the threat. Meanwhile, business operations are suspended, incident response teams are scrambling, and regulators are asking difficult questions.

Or consider a less visible but equally dangerous scenario: An attacker silently disables endpoint protections at the firmware level, exfiltrates sensitive data, and remains undetected for months. By the time the breach is discovered, it’s already a compliance crisis, a reputational hit, and potentially a massive financial loss.

In both cases, the root cause lies beneath the OS… Where no one was looking: The BIOS.

How FirmGuard Can Help

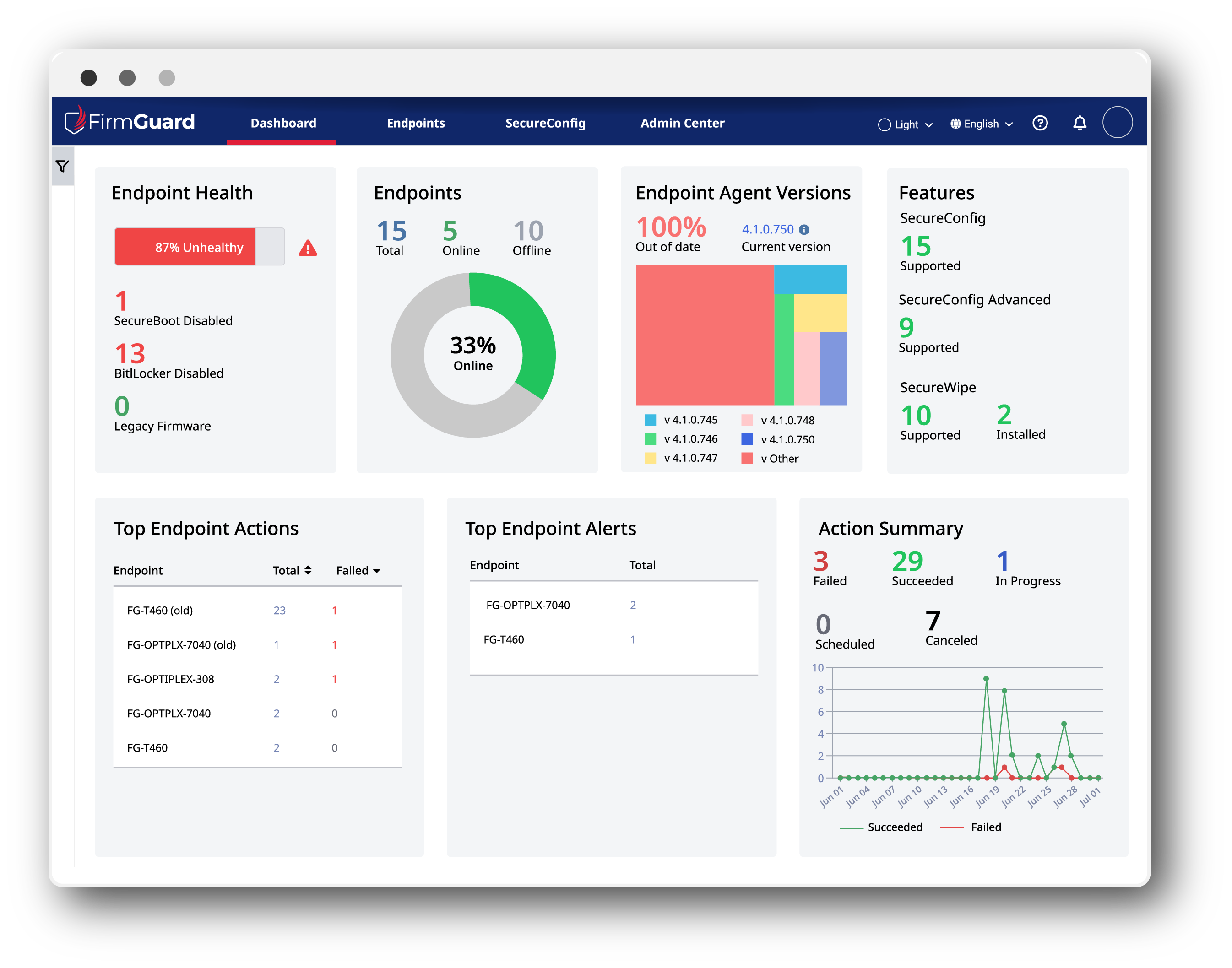

FirmGuard enables financial institutions to gain control at the firmware level. Our platform is designed to integrate seamlessly into existing environments, providing the security teams need to monitor, manage, and secure BIOS firmware at scale.

Here’s how we help financial institutions close the BIOS security gap:

BIOS Visibility and Integrity Monitoring

SecureCheck provides consistent visibility into BIOS firmware by measuring key TPM Platform Configuration Registers (PCRs) during each system boot. It detects unauthorized changes by comparing these values against a known-good baseline, alerting your team to potential tampering or firmware compromise.

Remote BIOS Configuration

BIOS configurations vary widely, and misconfigurations can pose a serious security risk. Our SecureConfig feature allows you to define, enforce, and audit BIOS settings at scale. From disabling unused ports to enabling TPM and Secure Boot, you can ensure every device adheres to your security policies.

Remote Endpoint Drive Erasure

SecureWipe enables a trusted OS drive wipe process that complements BIOS-level security by ensuring devices are thoroughly sanitized before decommissioning or repurposing. While it does not modify firmware, it helps confirm that systems are in a known-good state prior to asset retirement.

Remote BIOS Update

Unmanaged firmware updates can introduce risk, especially when applied inconsistently or without verification. SecureUpdate offers a centralized, policy-driven approach to deploying vendor-signed BIOS updates across supported systems. This eliminates the need for manual flashing and reduces the risk of update-related errors.

Remotely Reimage an Endpoint

When used alongside SecureCheck, it supports validation of firmware integrity as part of a complete post-incident response.

As you can see, FirmGuard gives you the tools to manage firmware as a proactive part of your security strategy. Whether you’re a global bank or a regional credit union, our platform helps ensure BIOS security is visible, verifiable, and aligned with your operational and compliance priorities.

Don’t Let BIOS Security Fall Through the Cracks

BIOS firmware may sit beneath the radar of traditional cybersecurity tools, but it’s no longer beneath the radar of attackers. Or regulators. Financial institutions need to take this hidden threat seriously, not as a niche IT concern, but as a core pillar of enterprise risk management.

The question isn’t whether firmware will become a target – it already is. The real question is whether institutions will proactively secure it before the next breach, or reactively explain why they didn’t.